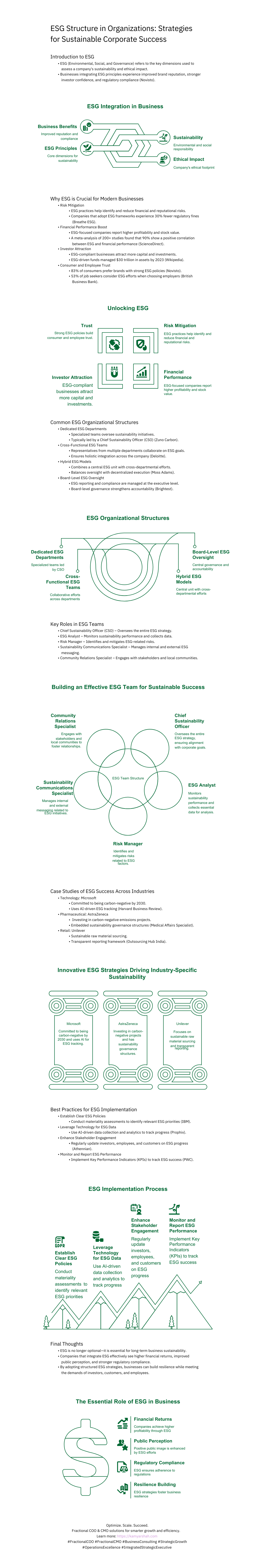

Implementing a robust ESG (Environmental, Social, and Governance) structure within organizations is crucial for achieving sustainable corporate success and fostering long-term competitive advantage. By aligning ESG principles with core business strategies, companies significantly enhance their ethical impact, risk management, stakeholder trust, and regulatory compliance. Effective ESG integration involves clearly defined organizational structures—such as dedicated ESG departments, cross-functional teams, or hybrid models—and strategic roles like Chief Sustainability Officers, ESG Analysts, and Risk Managers to drive accountability and performance. Businesses adopting industry-specific ESG strategies and best practices consistently demonstrate stronger financial resilience, improved public perception, and superior stakeholder engagement. Embracing comprehensive ESG frameworks addresses contemporary sustainability challenges and positions organizations for lasting success and market leadership.

Introduction to ESG

ESG (Environmental, Social, and Governance) refers to the key dimensions to assess a company’s sustainability and ethical impact.

Businesses integrating ESG principles experience improved brand reputation, stronger investor confidence, and regulatory compliance (Novisto).

Why ESG is Crucial for Modern Businesses

Risk Mitigation

ESG practices help identify and reduce financial and reputational risks.

Companies that adopt ESG frameworks experience 30% fewer regulatory fines (Breathe ESG).

Financial Performance Boost

ESG-focused companies report higher profitability and stock value.

A meta-analysis of 200+ studies found that 90% show a positive correlation between ESG and financial performance (ScienceDirect).

Investor Attraction

ESG-compliant businesses attract more capital and investments.

ESG-driven funds managed $30 trillion in assets by 2023 (Wikipedia).

Consumer and Employee Trust

83% of consumers prefer brands with strong ESG policies (Novisto).

53% of job seekers consider ESG efforts when choosing employers (British Business Bank).

Common ESG Organizational Structures

Dedicated ESG Departments

Specialized teams oversee sustainability initiatives.

Typically led by a Chief Sustainability Officer (CSO) (Zuno Carbon).

Cross-Functional ESG Teams

Representatives from multiple departments collaborate on ESG goals.

Ensures holistic integration across the company (Deloitte).

Hybrid ESG Models

Combines a central ESG unit with cross-departmental efforts.

Balances oversight with decentralized execution (Moss Adams).

Board-Level ESG Oversight

ESG reporting and compliance are managed at the executive level.

Board-level governance strengthens accountability (Brightest).

Key Roles in ESG Teams

Chief Sustainability Officer (CSO) – Oversees the entire ESG strategy.

ESG Analyst – Monitors sustainability performance and collects data.

Risk Manager – Identifies and mitigates ESG-related risks.

Sustainability Communications Specialist – Manages internal and external ESG messaging.

Community Relations Specialist – Engages with stakeholders and local communities.

Case Studies of ESG Success Across Industries

Technology: Microsoft

Committed to being carbon-negative by 2030.

Uses AI-driven ESG tracking (Harvard Business Review).

Pharmaceutical: AstraZeneca

Investing in carbon-negative emissions projects.

Embedded sustainability governance structures (Medical Affairs Specialist).

Retail: Unilever

Sustainable raw material sourcing.

Transparent reporting framework (Outsourcing Hub India).

Best Practices for ESG Implementation

Establish Clear ESG Policies

Conduct materiality assessments to identify relevant ESG priorities (IBM).

Leverage Technology for ESG Data

Use AI-driven data collection and analytics to track progress (Prophix).

Enhance Stakeholder Engagement

Regularly update investors, employees, and customers on ESG progress (Athennian).

Monitor and Report ESG Performance

Implement Key Performance Indicators (KPIs) to track ESG success (PWC).

Final Thoughts

ESG is no longer optional—it is essential for long-term business sustainability.

Companies that integrate ESG effectively see higher financial returns, improved public perception, and stronger regulatory compliance.

By adopting structured ESG strategies, businesses can build resilience while meeting the demands of investors, customers, and employees.